The echoes of "peak hawkishness" have been around since the January Fed meeting. However, the Fed rhetoric has continued to ratchet up as inflation data has continued to run well ahead of their expectations and Ukraine war and China lock-down have skewed the risks to inflation further to the upside. The market has gone from pricing a benign Fed cycle at the beginning of the year to one that is expected to overshoot Fed's estimate of neutral.

Given the sense of urgency at the Fed and current level of inflation and unemployment, it's low probability that the Fed stops before its estimate of neutral range of 2 - 2.5% and it's reasonable likelihood that Fed hikes beyond that. But in trying to answer the question, "Are we there yet?" understanding the Fed's reaction function is key. The assumption in the market is that Fed hikes will raise probability of recession sufficiently to cause the Fed to halt its tightening cycle. While that's a generally reasonable construct, the conditionality associated with a Fed pause is a bit more complex. I'm not a fan of long notes but unfortunately this is a pertinent question and there's a lot to unpack here.

The key variables to consider on the Fed's radar in assessing sufficient progress to pause its tightening cycle are -

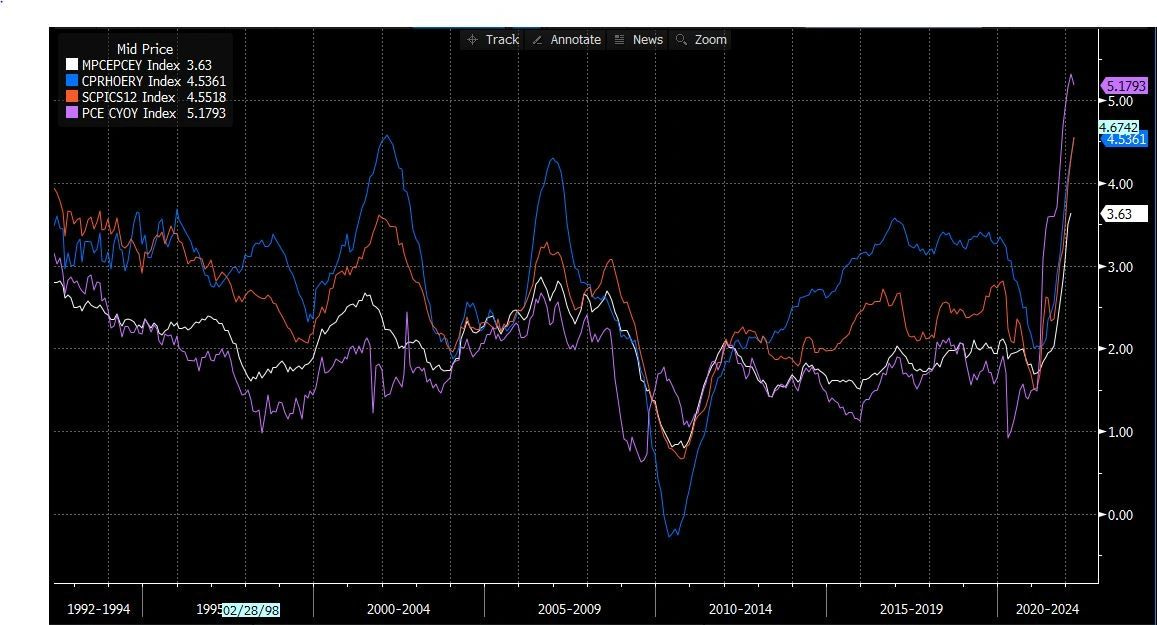

Core Inflation - Historically this has been the most pertinent variable in assessing Fed's reaction function. The rationale is consumer price index excluding usually volatile food and energy prices is better representation of underlying inflationary trends. Post-Covid, the supply/chain disruptions impacting goods prices and sharp moves in prices in categories most severely impacted by Covid has induced high volatility in this series. While it is clearly well above the Fed's mandate, it isn't unreasonable that easing of some supply constraints and rotation of spending away from goods to services could cause this measure over a 12-month period to be in the zip code of the Fed's mandate. This is a necessary but far from sufficient condition for the Fed to pause.

Trimmed Mean / Sticky Core Inflation - The trimmed mean and the core sticky inflation somewhat addresses the issues posed by Covid in using core inflation and arguably a better measure of trend by its focus on the slower moving inflation categories. These measures are actually sending a concerning message on underlying inflation trends. Shelter costs are a big contributor to these inflation metrics and they have higher correlation to labor market and typically lag home price appreciation by 12 to 18 months. So the expectation is that these measures will continue to be elevated for some time and unlikely to give Fed a green signal to pause tightening anytime soon.

[Purple - Core PCE, White - Dallas Trimmed Mean, Orange - Core Sticky, Blue - Shelter Inflation]

Inflation expectations - This is kryptonite for central bankers anywhere. The idea that inflation expectations could unanchor creating a self-fulfilling inflation spiral is every central bankers worst nightmare because it represents an erosion of central bank credibility. From a reaction function standpoint, even a small rise in the probability of this occurring opens up a catastrophic fat tail invoking a strong response from the central bank - something we saw post-GFC and post-Covid in response to downside risks to inflation expectations. We haven't really seen it triggered on the upside risks to inflation in the past (during Volcker expectations were already unanchored) but that's where we are today. The hard part is measuring inflation expectations in real-time is difficult as the shorter dated inflation expectation measures are highly correlated to oil and longer-dated measures are sticky and slow moving. But persistence of high realized inflation could lead to short term inflation expectations spilling over to the longer term measures and posing credibility risks for the Fed - so they can't be dismissed entirely. In fact one of the rationale for 'Average Inflation Targeting' was the idea that persistent realized inflation experience away from Fed target of 2% in the same direction risks dislodging longer term inflation expectations. This makes the Fed reaction function somewhat correlated to energy and food prices - even though arguably its policy is unlikely to have a major impact on those prices unless it pushes economy into a sharp recession forcing demand destruction.

[White - U Michigan Survey 1y Inflation Expectations, Blue - U Michigan Survey 5y Inflation Expectations, Orange - 5y5y Inflation Breakeven]

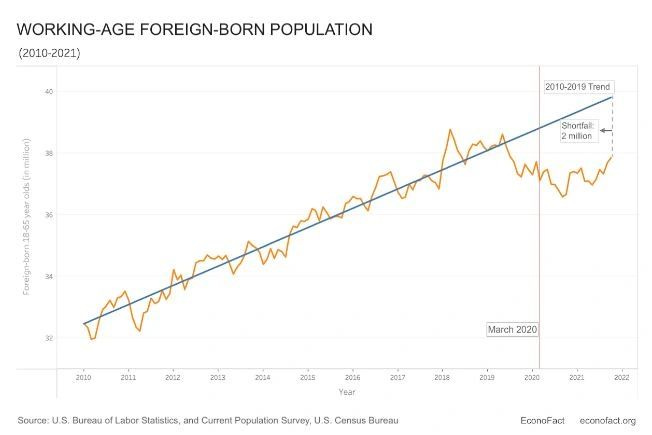

Labor market tightness - This is clearly where the Fed is most focused on today and a primary driver behind its intent to get to neutral expeditiously. Moving away from volatile core inflation and transitory narrative around it, the Fed has zeroed in on using the labor market tightness as the best north star to calibrate its tightening cycle. Here in lies the Achilles heel for the Fed reaction function - not because its not the right measure but because the calibration could be incredibly difficult for a variety of factors.

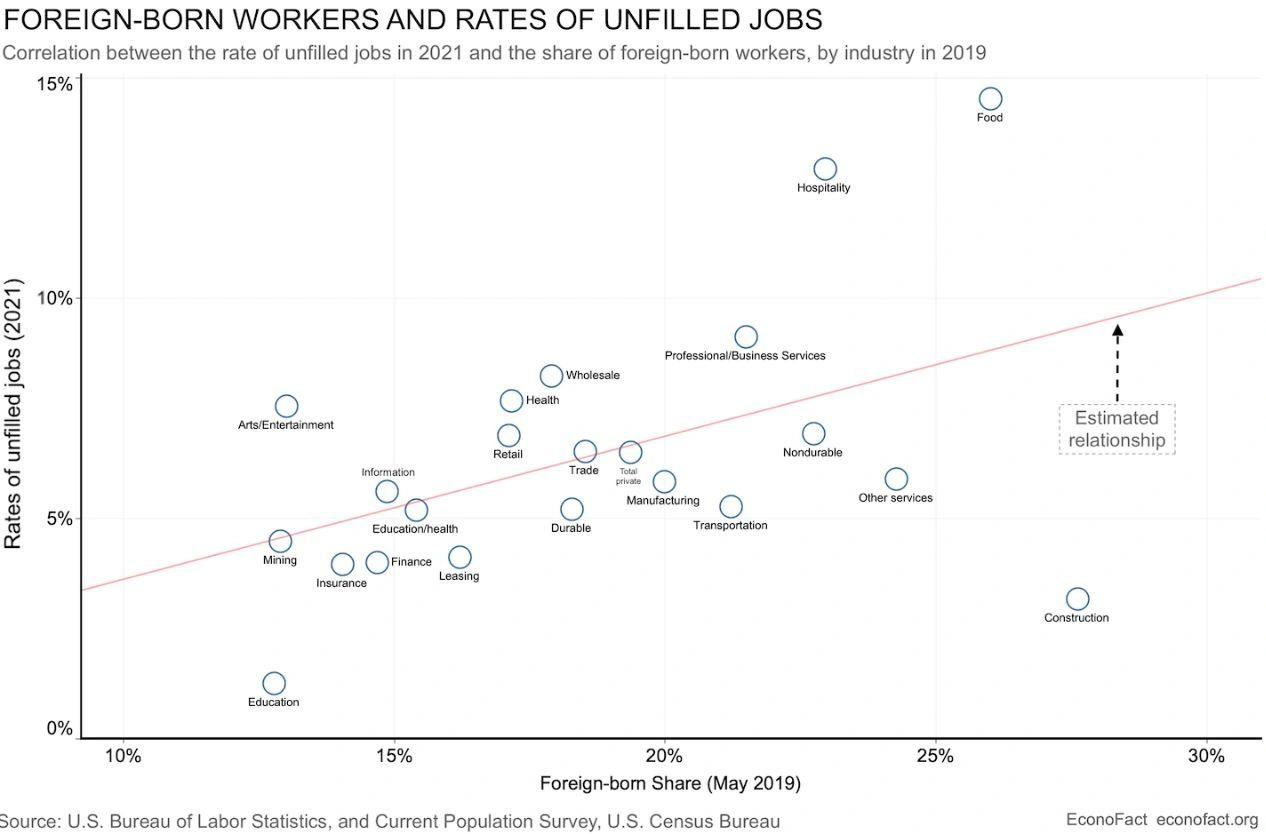

Firstly, around 15% of the labor market is employed in the goods sector and even if you include the trade/transportation/warehousing sectors it still is only 1/3 of the total workforce. While the goods to services spending rotation should ease core goods inflation, it might actually make the labor market tightness worse by boosting demand for services sectors.

Secondly, three measures of labor market tightness - job vacancy rate, quit rate and wage inflation - remain among the highest for the service sectors most severely impacted by Covid - healthcare & education and leisure & hospitality services. As the mobility continues to normalize, despite the Fed's tightening cycle its difficult to see the momentum in these sectors declining sufficiently and quickly to ease the labor market tightness. Furthermore, the shrinkage in labor force from declines in immigration and reduction in women's labor force participation due to childcare issues during Covid disproportionately impacts these sectors. Early retirees - another factor depressing labor force participation - in general have higher Covid vulnerability and might be hesitant to return to employment in these higher risk sectors.

Thirdly, even if the economy were to go into a shallow recession - as typically defined by decline in real GDP for consecutive quarters - inflation will likely still be stickier this time and firms can reduce labor spending via negative real wages instead of firing workers (as is usually the case in recessions when inflation falls sharply). This probably increases the lag and decreases the potency at which the Fed policy will impact the labor market. It might require the Fed policy to tighten significantly and cause a deeper recession to push inflation down and unemployment rate higher.

Lastly, if the Phillips Curve is flatter and part of shortage of labor supply is a structural issue, the size of the Fed policy tightening above neutral required to engineer a decline in economic activity large enough to slow wage inflation is probably much larger than current market implied levels.

Financial conditions - As I've written in my previous blogs, tighter financial conditions is what the Fed is unequivocally trying to achieve. So financial conditions would have to tighten by a magnitude large enough where they posed serious economic spillover risks to push the Fed to consider pausing the tightening cycle in response to that.

In summary, inflation categories that have had out-sized moves are likely to moderate and even reverse pushing overall inflation lower but the slower moving stickier components of inflation are likely to keep the Fed tightening cycle persistent even if at a slower pace. And unlike in the past, supply shocks to energy and food prices cannot be completely ignored by the Fed due to risks they pose to inflation expectations. Moreover, the composition of where the labor market tightness is concentrated, structural issues with labor market supply and flatness of Phillips curve blunts the impact of Fed policy in slowing wage inflation and will likely force the Fed into a longer and larger tightening cycle. Lastly, financial conditions tightening will need to be large and accompanied by sufficient progress on inflation and employment to get the Fed to halt the cycle. This puts me in the camp that this Fed cycle is going to go further above neutral and last longer than priced unless they move the goalposts on whats an acceptable level of inflation. This makes hard landing the highest likelihood outcome with a thin tail of a soft landing and fatter tail of a crash landing. But that hard landing may not be here for a while.

Really great analysis, thanks!

Given your view where do you see the $USD going? DXY at 120 and EURUSD well below parity? Inflation and growth dynamics in RoW point in the opposite direction. Absent another exogenous shock like covid I really struggle to see how Europe and Asia can match the US over the next 2 years.