Out-of-the-Box Tightening

There are many moments in sports which have highlighted the impact of thinking outside the box, but none have made as great an impression on me as the 1989 French Open 4th round match between 17-year old Michael Chang versus 3-time French Open Champion and number one seed Ivan Lendl. He went on to win the French Open and become the youngest men's tennis player to win a Grand Slam title - a record that stands till-date.

The Fed and other central banks over the past decade - particularly in response the Covid shock - have shown tremendous creativity in developing and implementing unconventional tools. Yet, when it comes to dealing with the risks of multi-decade high inflation, they've reverted to primarily using the short term interest rate level aggressively. The market is now debating 50bp or 75bp from 25bp or 50bp just a week ago with little new information on the economic or inflation front. Pursuing an aggressive hiking path as the predominant tool to achieve the inflation objective has a few challenges -

Once the market prices in a pace of hike, the bar to surprise hawkishly is higher and harder to build consensus around and deliver

If the brunt of the tightening is borne by the front-end with the curve inverting massively, the pass-through of policy to longer-term rates which have larger impact on the economy is lower

Risks of abrupt tightening in financial conditions short circuiting the duration of the tightening cycle increase - its not enough to tighten FCI, they need to be sustained to slow demand.

Risks of hard landing are much higher with an aggressive front-loaded cycle.

The difference between the Fed achieving a soft-landing and hard-landing on its ability to ease in the future is underappreciated. If the economy has a hard-landing and consistent with the Eurodollar futures market, Fed is reversing policy in 2023 the Fed would almost certainly have to pause QT. This prevents the Fed from shrinking the balance sheet substantially and will potentially limit its ability to ease policy in the future.

Additionally, post-Covid the balance sheet did much of the heavy lifting in easing policy. Excess reserves from Fed's QE program is effectively 'unused lending capacity' that exists in the system that can be released should the banks choose to increase C&I loans. This poses an upside risk to growth and inflation hampering the Fed's efforts to bring inflation back to target.

So maybe its time for the Fed to put on their thinking caps and explore out-of-the-box ideas to tighten policy.

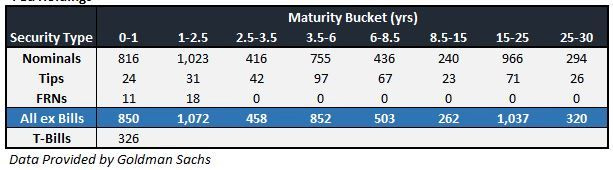

For one, it could be much more aggressive on the balance sheet tightening. Of course, the immediate response is they are maxed out on run-off and asset sales of treasuries would be catastrophic to functioning of the treasury market. I agree with the broad idea that goal of QT is to tighten policy by raising financing costs not by increasing volatility from deteriorating liquidity in markets. But here is the composition Fed's treasury portfolio -

One elegant solution could be that the Fed does a swap of its longer maturity (>6 years) treasury portfolio with the Treasury for a portfolio with shorter-dated securities (< 2 years). With the former Fed Chair Yellen at the helm of the treasury and a shared goal to bring inflation lower, there has never been a better time to be able to do this. The shorter duration treasury portfolio would allow the Fed to do QT at a higher pace without asset sales and the treasury could adjust its issuance schedule to absorb the duration transfer from the Fed and spread it out across the curve. Perhaps there are other creative ways to achieve this but the discussion on how to speed up QT should certainly not be brushed aside.

Another idea, probably really out-of-the-box for sure, is to consider 'forward guidance for tightening cycles'. The reason the yield curve inverts is that the market does not believe the Fed can sustain higher rates and will be forced to cut them in the not-too-distant future. Once the Fed gets to a rate above neutral (say 3 or 3.5%), it could commit to 'keep rates at or above these levels until inflation is close to its medium term 2% target on a sustainable basis". This could limit the curve inversion and be propagate the impact of the Fed's tightening further out the curve.

The Fed used a broad set of tools to ease policy. It has to be able to show that it can bring inflation back to target without inflicting severe damage on the economy to preserve its credibility. To achieve this, the ability to sustain tighter monetary policy for longer is just as important if not more important than the getting to a tight level of monetary policy quickly. The Fed is not short on creativity and it is time to think outside the box to use the full set of tools to get inflation down to their target. Using a sledgehammer of larger and larger rate hikes to swat the inflation fly (however large the fly maybe) will likely inflict significant collateral damage to the economy and markets and cause permanent scarring impacting policy potency in the future.

I agree 100%. The whole idea of QE was to offset the constraint posed by ELB. To the extent that fiscal more than fully offset that constraint in the post COVID cycle, there was no need to do any QE except to finance the fiscal spending.

Curve inversion normally occurs towards the end of a tightening cycle. Given a 9T balance sheet, the current inversion is not signaling anything meaningful. Your idea of a reverse twist is quite clever. Cleveland Fed has been pushing QT as a precursor to hiking FF. LIFO principle would suggest that its a sensible sequencing. However, its too late for the Fed to have this luxury. Their best bet at a soft landing (however rwmote) is to let both ends of the curve work for them.

In any case, if as you mention, they have to stop QT in 2023 and find themselves with 7-8T balance sheet, QE as an easing tool will disappear. Atleast it should!