PutPourri

The birth of the Fed Put goes all the way back to October 1987 when Greenspan Fed responded forcefully to precipitous stock market decline on Black Monday ushering in a new era of investor confidence in the Fed's ability to respond to and reverse severe market downturns. One could argue that after decades of monetary interventions to stock market declines, a "Pavlovian" response is embedded in the psyche of market participants.(scene from The Office explains it better than my Ctrl+C / Ctrl+V of the wiki description)

Lot of ink has been spilled on analyzing the Fed Put and whats the strike at which it gets triggered. While the simple idea that you 'Buy the Dip' cause the 'Fed's got your back' has definitively been a winning strategy for over a decade including during the post-Covid single largest quarterly economic drop in history, the current economic environment and central bank policy stance probably warrants a deeper dive.The market definition of the 'Fed Put' can be characterized as a rapid price drop in equities larger than a certain threshold that triggers a dovish pivot from the Fed. It is deemed largely unconditional on anything else other than magnitude of decline.

There are a couple of concepts to analyze in thinking about the Fed Put. First is the conditionality. Second is decomposing the price drop into increase in equity risk premium and decline in forward earnings and assessing the threshold for each component (though they aren't strictly independent).

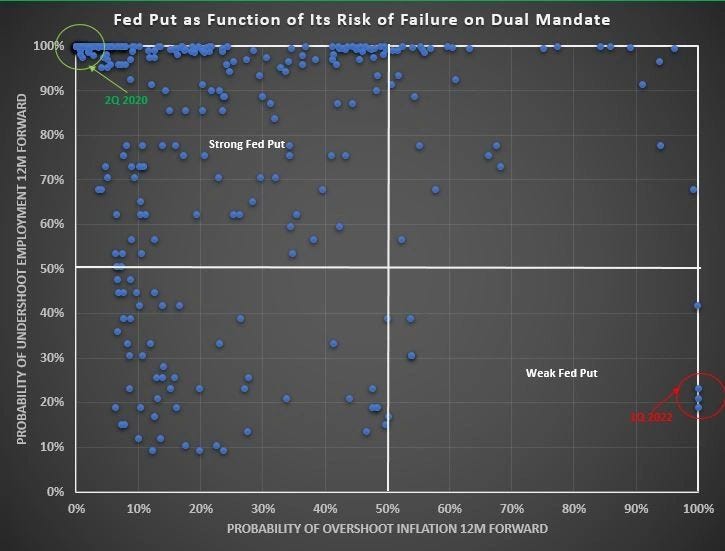

Conditionality of Put - In my view, the Fed Put is not unconditional. It is rooted in the idea that an unchecked large unwarranted abrupt tightening of financial conditions could translate into a macroeconomic shock that moves the Fed away from achieving its dual mandate objectives. In this context, the starting point of Fed in reference to its dual mandate objectives is critical. The graph below is what I call the 'Fed Failure Graph'. It is a scatter plot (past 30 years) of Fed's probability of overshooting on inflation 12m forward (i.e. missing to the high side) versus Fed's probability of undershooting on unemployment rate 12m forward (i.e. missing to the high side). In the top left corner, where the Fed is at high risk of undershooting its employment mandate and low risk of overshooting its inflation mandate the Fed Put (2Q 2020) is strongest and conversely at the bottom right corner, the Fed Put is weakest (1Q 2022).

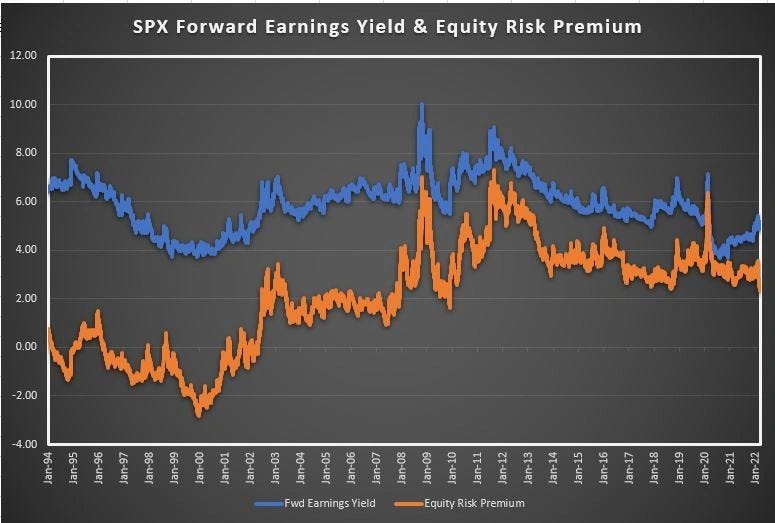

Put on Equity Risk Premium - The Fed Put has the most immediate and direct impact on lowering Equity Risk Premium. This is even more true in the post-GFC era where the balance sheet has material direct impact on risk premium. In the current environment, equity valuations are still very rich as measured on most metrics and a widening of Equity Risk Premium wouldn't bother the Fed too much.

Put on Forward Earnings Growth - To a first order approximation this is equivalent a put on forward nominal GDP growth. From the Fed's perspective the most worrisome outcome of decline in equities if it reflects a worsening growth and earnings outlook in which weak equity markets and weak economy can interact to create a negative reflexive feedback loop. Providing a put on nominal growth is consistent with Fed achieving its dual mandate. But with the economy currently running at over 10% nominal GDP, the Fed is looking to actively slow growth to curb inflationary pressures making it highly unlikely that this put is triggered absent a large external shock to growth. The one nuance in the current environment is that the mix of inflation and real GDP growth could deteriorate such that earnings growth is impacted negatively due to higher inflation impacting margins even with reasonable nominal GDP growth.

In conclusion, given the Fed's starting point the conditions for triggering the Fed put are not in place and a re-rating of equity multiples lower seems logical as the Fed tightens policy (particularly QT). But until the nominal growth picture deteriorates substantially i.e. recession risks rise materially, the downside in equities is unlikely to trigger the Fed put.

Roughly speaking, a S&P forward multiple of 16x (historical average) and a drop in forward earnings growth to 0% from 15% currently (i.e. close to 200) might get us to the threshold (S&P ~ 3200) where the discussion of exercise of Fed Put becomes a valid one. This is over 30% away from current prices. But this is a moving target depending on level of equity risk premium and earnings realization.

Equity put skew should trade at historical highs reflecting that the Fed Put on the downside is deep out-of-the-money and Fed is acting aggressively to truncate the distribution to the upside.